In the last blog about statutory changes to the warranty, we wrote about how important it is to hand over the vehicles at the time of sale to the buyer for use together with the warranty for used vehicles. While this cannot legally relieve you of liability under the new law, financially speaking, the warranty can take on the high financial consequences of vehicle repair if it proves necessary.

In this case, the warranty helps you to resolve one part of the discrepancies that may occur in the vehicle, which means that it is very important for your business.

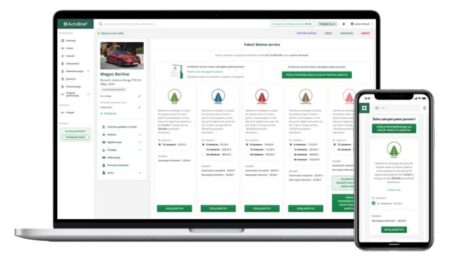

Use the AutoBrief platform for quick warranty issuance

All users of the AutoBrief platform already have the digital issue of the used vehicle warranty available directly on the platform itself. In this way, our platform practically does not need to be abandoned, as AutoBrief enables fast, digital and automated warranty issuance together with our partner Motive Service. The warranty is issued through the AutoBrief platform with just a few clicks. The process is extremely fast and easy, and is entirely a digitized, paperless and safe business.

Within the platform, you simply select any warranty package, and in some cases, you choose the duration of the warranty.

In addition, the platform allows you to automatically fill in the documentation without time-consuming handwriting and calculations. The use of previously entered vehicle and customer data in AutoBrief automatically completes itself, saving you from having to re-enter previously entered data and potentially resulting in an error.

This allows you to create a guarantee immediately, without the need for time-consuming switching from one program to another or from one side to the other. Everything is done on a single platform with a few clicks.

At the same time, the fact that an automatic calculation of costs per add-on is available within AutoBrief as well as within an individual package is also negligible to me. There is also an archive of all warranties already issued, which makes it easier for you to review the business or any subsequently requested documentation.

Since we know that it is easier to watch everything through video, we have also recorded the user experience of issuing guarantees through the platform itself.

For all those who are not yet our users, the video is a welcome explanation of how simple the procedures inside our platform are and how much less time traders need for all paperwork and administration. That is also something that is written in the interview with Benjamin Čater where he talks about how much less work he has to do because of AutoBrief.